Archives

Air, Freight News

Air cargo Christmas cheer in short supply

[ November 1, 2023 // Chris Lewis ]Global air cargo volumes and spot rates edged up marginally in October, but overall demand remained muted, diminishing hope of a traditional year-end revenue boost, according to Xeneta’s latest analysis.

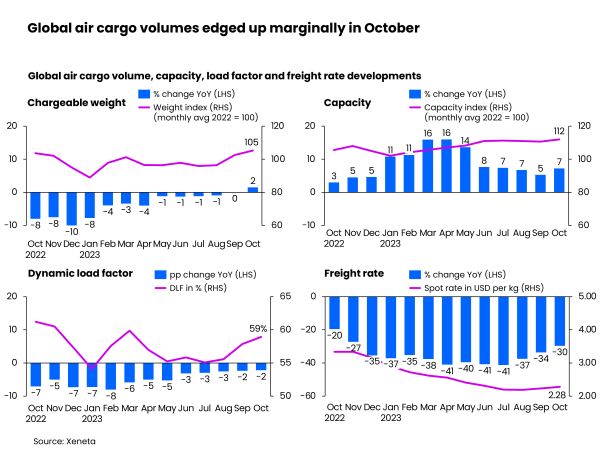

Latest industry data shows a 2% month-over-month improvement in airfreight volumes in October, which was sub-seasonal compared to the previous five years, while general air cargo spot rates edged up 2% versus September to US$2.28 per kg, rising above seasonal rates in the opening two weeks of October for the first time since mid-May 2023 before falling back to below the seasonal level.

In comparison to last year, the global air cargo spot rate declined at its slowest pace, -30% in October. This is attributed to the slight uptick in global cargo volumes as well as a slowdown of capacity growth in a month in which global belly capacity returned to its pre-pandemic level, albeit this recovery is varied across major lanes.

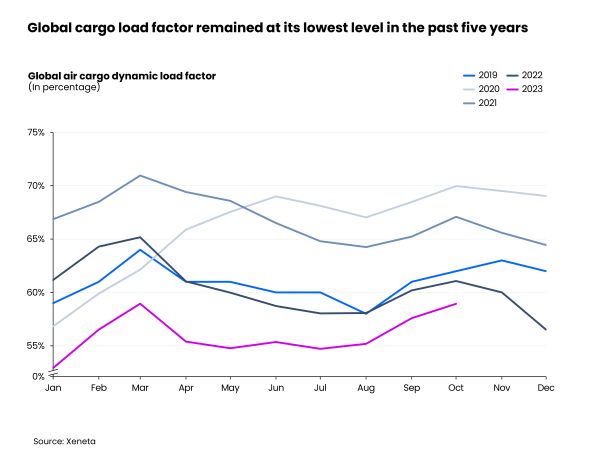

Global dynamic load factor, which measures both volume and weight perspectives of cargo flown and capacity available, climbed to 59% in October, but remained 2 percentage points below a year ago. Across the first 10 months of 2023, load factors have been below all the corresponding monthly levels of the last five years, pointing to a persistently weak global air cargo market.

Xeneta chief airfreight officer, Niall van de Wouw, said: “October’s market performance is what we expected to see. It was a marginally busier month but not a cause for much optimism, nor pessimism. Carriers and forwarders are not expecting the market situation to improve significantly until well into the second half of 2024.

“The ongoing situation in Ukraine and now the conflict in Israel and Gaza will only add to these concerns. This is a volatile market. Freight forwarders are still procuring capacity on a short-term basis but are selling more long-term. That’s a risk, but clearly forwarders are not willing to commit to capacity because of so much uncertainty.”

Against this backdrop of a still-soft cargo market, global carriers continued to register declines in their October revenues, down 26% overall from the same month last year. This is also reflected in trends reported in carriers’ latest Q3 results, although October 2023 revenues still outperformed October 2019’s pre-pandemic numbers by 21%.

One reason for the higher-than-2019 revenue is the still wide freight rate spread. High rates for premium and special cargoes remained elevated and not yet fully normalized, while the low rates for general cargoes have nearly gone back to their pre-pandemic levels.

Overall, carriers continued to suffer from rising operating costs. Jet fuel costs remained high. Rising wage rates triggered by high inflation and labour shortages also pushed up operating costs. This is likely to be especially challenging for cargo airlines that do not have the added benefit of passenger revenues.

Spot rates from Europe to the US stood at $1.85 per kg in October, up 7% from a month ago. This is because the market anticipates declines in cargo capacity as space availability on this corridor is highly influenced by carriers’ seasonal passenger schedule adjustments, which began on 29 October this year. At the same time, volume measured in chargeable weight edged up 3% from a month ago. However, this represented a considerable 10% decline from the same period a year earlier.

October air cargo spot rates from China to Europe climbed +14% month-over-month to $3.66 per kg, while Southeast Asia to Europe spot rates rose at a slightly slower pace of 9% to $2.51 per kg in the same period. In comparison, the transpacific market saw these two origins show the reversed trends.

Spot rates from China to the US increased just 10% from a month ago to $4.00 per kg, while spot rates from Southeast Asia to the US jumped a considerable 15% to $3.61 per kg. The rise in spot rate for the latter corridor is mainly driven by a sharp growth in chargeable weight month-on-month.

Tags: Xeneta